Money for education in the Sunshine State comes from a few different places — property taxes, state sales tax and proceeds from the Florida Lottery chief among them.

The single biggest pot of money is local property taxes, and luckily for Florida schools, Floridians own a lot of real estate, worth nearly $4 trillion statewide. From that, Florida generates more than $13 billion in local property taxes, which cover about half of what we spend on public education across the 67 counties.

The Jacksonville area accounts for about 6.4% of the state’s property tax base for schools.

Over the last 25 years, Duval’s school tax base has increased more than 320%, amid a population boom and increased property values.

Q. This Number of the Week is also an #AskJAXTDY. Jacksonville Today reader Jane G. wonders what happens to the money Duval Schools collects from property taxes.

“There are four different school taxes on the property tax bill, including a recently approved voter tax and capital tax,” she wrote to us.

“With the expansion in real estate, where is this bounty of tax money?”

-Jane G.

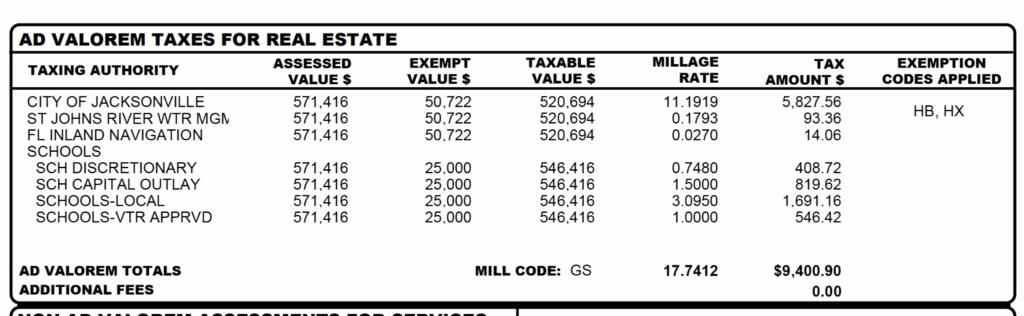

A. Property taxes talk in terms of “millage rates” — essentially, a proportional tax rate. For every 1 mill, a homeowner will pay $1 per $1,000 of assessed value on their property. If their home is worth $100,000, a tax of 1 mill equals $100.

As Jane correctly states, there are four separate property taxes for schools in Duval County; they equal a combined millage rate of 6.3430:

- Discretionary (.7480): Levied annually by the county School Board, but capped by the state. This money stays in the county.

- Capital Outlay (1.5000): Also levied annually by the school board, it funds buildings and transportation.

- Local (3.0950): The state directs Duval to collect this tax, and the state sets the rate. It goes to Tallahassee and is added to the funding that eventually makes its way back to Duval County.

- Voter Approved (1.000): Duval County voters approved this tax in 2022. It mostly funds teacher pay.

‘Local’ tax goes to the state — and comes back

When it comes to the path that dollars take from property owners’ pockets to local public schools, about half of their money goes to the “required local effort” of per-student funding that comes from property taxes. (On our bills, that’s the roughly 3-mill “local” tax line.) Florida disburses this money back to districts according to how many students they have enrolled.

Because wealthier counties with higher tax burdens pay a larger share of this state-required tax bucket, they effectively supplement education funding in poorer counties.

The Florida Education Finance Program uses a labyrinthine formula that accounts for counties’ cost of living, tax base and other factors to arrive at the per-student dollar amount it sends to districts. This money covers schools’ day-to-day operating expenses — teacher salaries, textbooks, electricity and water, and support staff like custodians, guidance counselors and librarians.

Districts also have the option of levying a school tax that stays within their counties. The state caps this tax at .7480 mills, which is the rate that all 67 counties currently use.

The 1 mill voter-approved tax

Some districts — Duval among them — also add property taxes and sales taxes to boost teachers’ salaries and pay for construction projects.

On Duval County property tax bills, this is the 1.5 mill for capital outlay, which is approved annually by the school board, and the 1 mill “voter approved” tax, which Duval voters elected to add in 2022 to improve teacher pay, mostly. (You might remember that Duval voters had also passed a half-penny sales tax before that, and it funds construction projects and improvements to school buildings.)

Duval Schools’ original projections said the 1 mill tax would generate an extra $108 million for the district annually. It has surpassed that goal; for the current fiscal year, the district is counting on it bringing in almost $125 million. That’s our Number of the Week.

$124,836,634

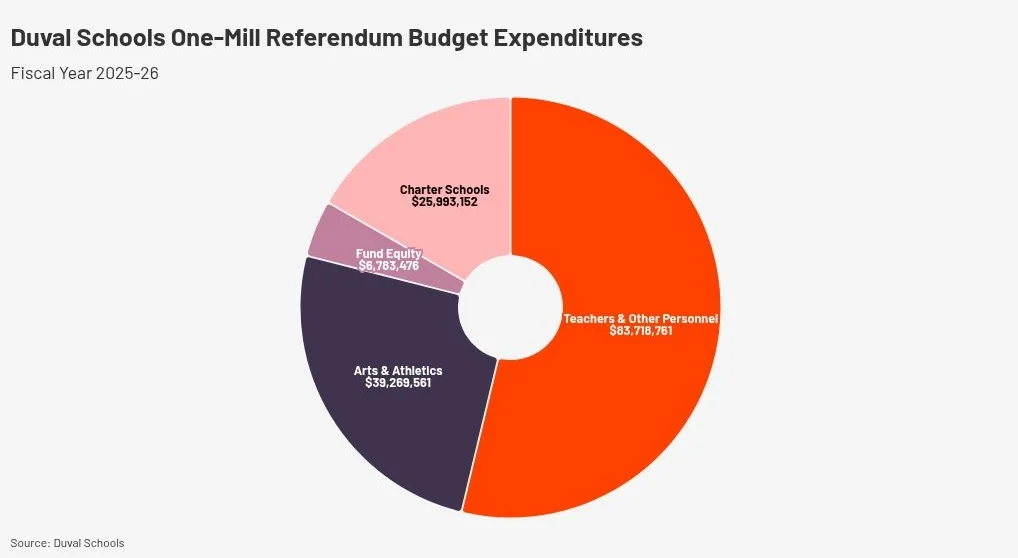

Recent changes to state laws require districts to share some tax revenue with charter schools, so traditional schools’ share of that will be a little less than $100 million.

Duval Schools uses the 1 mill tax to supplement pay for teachers and other staff — about $5,000 to $7,000 annually, depending on the employee’s pay rate — and invest in athletics and arts programs.

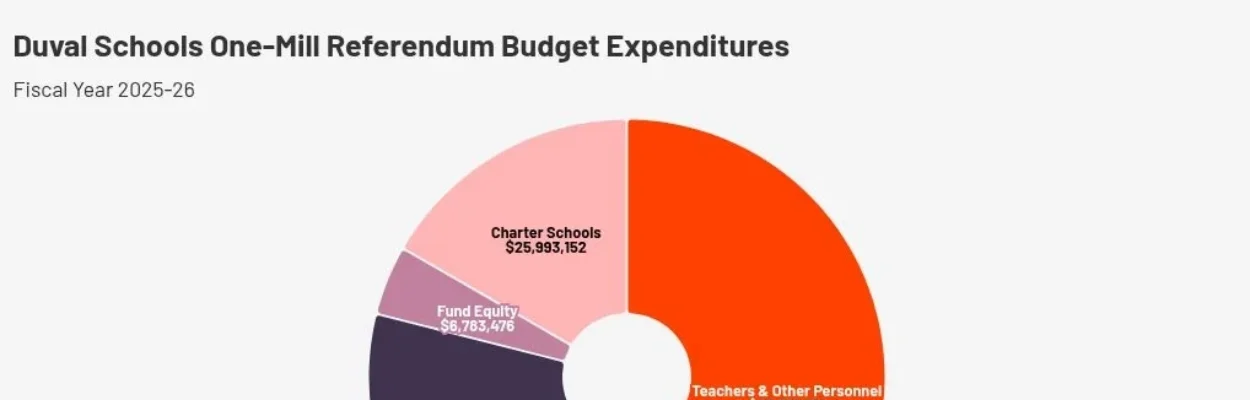

For the current fiscal year, Duval Schools had about $31 million left over from previous years, so the total 1 mill revenue in its budget is about $156 million. Here’s how it’s being spent:

In Duval, property taxes have added turf fields, bought new band uniforms and instruments, updated playgrounds, installed bleachers, constructed middle school tracks, supported visual arts, and more. Check out Duval Schools’ dashboard of active projects for more.