The question of who may financially benefit from a proposed deal to swap land on the Downtown Jacksonville riverfront for a LaVilla property local officials want for a future University of Florida graduate campus became a focus for a few City Council members Wednesday during a special meeting on the proposal.

Leadership for Jacksonville’s Downtown Investment Authority and developer Gateway Jax, which owns the former Interline Brands building at 801 W. Bay St., appeared before city lawmakers to present and answer questions about Ordinance 2025-0319, which would execute a land-swap of the LaVilla building for a 1-acre parcel connected to Riverfront Plaza park currently under construction on the Northbank.

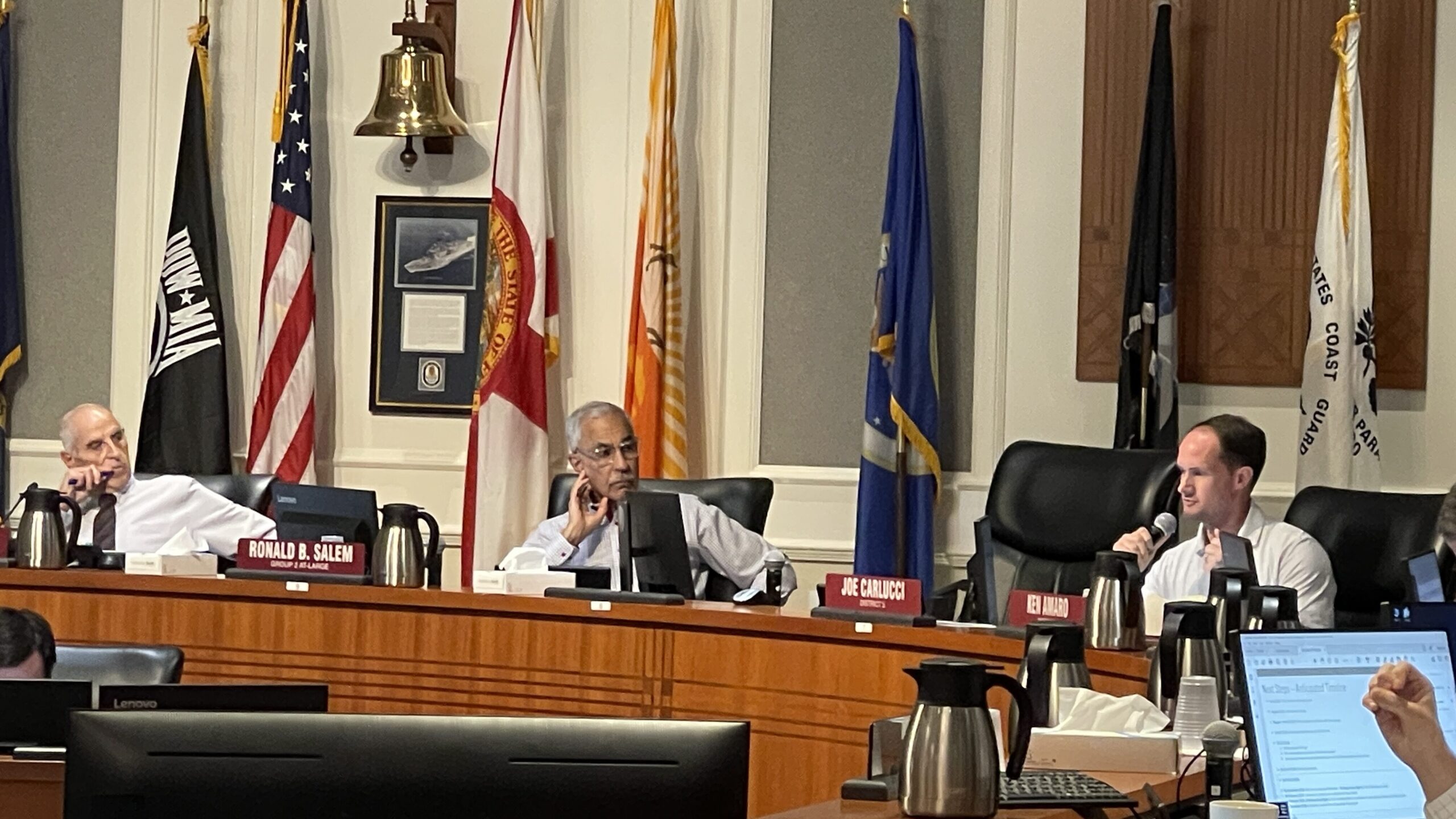

Finance Committee Chair Ron Salem, who’s been critical of the deal and is pushing competing legislation that would pay cash for the Interline building instead, asked Gateway CEO Bryan Moll to provide the names of investors in the company’s private equity fund supporting its Downtown developments.

“Let me make it very clear, if this was a strict (request for proposals), and Gateway Jax was bidding on this property, I couldn’t care less who your investors are. But in a land swap situation, I do want to know who your investors are,” Salem said. “It’s been offered by one of the representatives, if I gave you a name, you would tell me if that was an investor. The problem I have with that is, there are 19 of us and all 19 (Council members) need to know who those investors are, and more importantly, the citizens of Jacksonville should know who those investors are in the event of a land swap.”

Salem’s bill would approve no more than $8 million for the city to purchase the Interline site as opposed to a land-swap. Moll told the Council Wednesday that they would take $6.95 million for the property, which is the average of three appraisals — one conducted by Gateway and two others by the city.

UF officials want to move into the Interline building in August to launch what they say could be a 20-year plan to build out a 23.2-acre LaVilla graduate campus and Florida Semiconductor Institute. The city has already committed $100 million to the project.

In exchange for the West Bay Street property, Gateway wants the waterfront acre, plus the option to acquire a 1.77-acre parcel east of the Main Street Bridge.

“We have one of the best reason to want to be involved in this. We and our investors are spending hundreds of millions of dollars — will eventually reach $2 billion on development in Downtown within a half-a-mile away from this. We have an interest in making this happen. … The success of our company and investment rests solely on the success of the urban core and the Northbank of Downtown,” Gateway CEO Bryan Moll said.

If Gateway gets the riverfront property, it’s proposed building a minimum $100 million, 17-story building on the first parcel that includes a four-star boutique hotel with 130-170 rooms; condominiums; two full-service restaurants; a public terrace that overlooks the park and elements that would complete the Riverfront Plaza’s design, according to a legislative summary filed with the bill.

Gateway would only be able to acquire the site east of the bridge after it starts vertical construction on the first parcel. The company says the second site would include a minimum $25 million mixed-use project including a restaurant and 75 public parking spots.

The land-swap bill also acknowledges that the developer could ask for a $20 million completion grant later on.

The legislation also allows council to buy the riverfront parcel back from Gateway at $6.35 million, less than the value of the Interline property, if a development agreement cannot be reached within 15 months.

Gateway’s argument

Moll and DIA officials say Gateway’s development interests already underway Downtown, its ability to bring investors and capital to projects and it’s interest in helping complete the city’s planned design of the park Riverfront Plaza are why council should approve the land-swap.

According to Moll, Gateway owns and controls 32 acres downtown across 25 city blocks. Its equity fund’s two primary investors are DLP Capital and Jacksonville-based JWB Real Estate Capital, he says.

The group broke ground in October 2024 on the mixed-use Pearl Square in Downtown’s North Core — the first phase of what’s envisioned to become a broader $2 billion project.

Moll also said the riverfront development will be “key” for activating the transformed Riverfront Plaza.

“The Riverwalk is great and important, but it is so incredibly important that we provide those amenities alongside of those spaces to make them truly dynamic and vibrant or else there won’t be a reason to visit,” Moll said.

DIA board Chair Patrick Krechowski also sees Gateway’s proposal as an important part of the $56 million park vision.

“Instead of having a grand opening of an amazing riverfront park next to a patch of weeds surrounded by a chain link fence, we may be able to achieve a project that matches years of work … that will help financially support and activate an amazing public space. … We may have and an opportunity to bring a complete vision for this space to life,” Krechowski said.

‘Highly irregular’

Salem’s request for Gateway to ID the individual investors in DPL and JWB is an atypical request compared to requirements in other incentive deals between the city and private developers.

Cyndy Trimmer, a partner attorney with Driver, McAfee, Hawthorne & Diebenow representing Gateway, has provided legal services for many Downtown developers. She called the request “highly irregular.”

“We have never brought an investment company to this dais and asked them to disclose every single investor that participates in a fund. That is a highly irregular request,” Trimmer told council. “As their attorney, I am stating on the record I don’t believe it’s an appropriate request. They have told you the main investors. Even under Florida statute, lessor investors that have less percentage wouldn’t be required to do this. It’s just not an appropriate ask to suggest they’re ignoring you or initially hiding something.”

Salem was himself an investor in JWB from 2017 to October 2024 ,when he says he become fully divested from the company. After JWB expanded from single-family home development into Downtown projects, Salem had to recuse himself from voting on projects when the company sought city incentives.

Salem said Wednesday he felt he needed to be voting on many of JWB’s city-involved projects and asked the company’s president Alex Sifakis to “get me out of JWB.”

Council member Tyrona Clark-Murray pointed out Wednesday that providing an investor list was not a requirement for the Four Seasons hotel and office building’s $129 million incentives agreement — for a nearly $400 million project under construction, led by Jaguars owner Shad Khan’s development company Iguana Investments LLC.

Council member Chris Miller said, even if the request is unusual, he’s spoken with other developers who said revealing their investors wouldn’t be an issue.

Support for the swap

Council members Matt Carlucci and Rahman Johnson voiced their support for the land-swap deal Wednesday.

DIA CEO Lori Boyer says the city’s return would be at least $1.50 for every $1 invested.

“We seem to be trying to nickel and dime our way out of transformation. That’s what this deal is about,” Johnson said. “It’s about transformation as a whole, and if we want to attract brains and build community wealth and raise the bar on who we are as Jacksonville, sometime we have to choose vision over spreadsheets.”

Gateway has also committed to a 2% hotel surcharge that would provide recurring revenue dedicated to maintaining Riverfront Plaza. Boyer called it critical to the park’s long-term success.

“One of the concerns DIA has is that you have invested a lot of money in constructing these riverfront parks, and we want to see that they are well maintained and well operated over the long term,” Boyer said. “This provides a recurring revenue source to do that that is not dependent on general fund funding.”

The DIA board voted 5-2 in February to support the land-swap.

$20 million incentive

DIA officials say the agency plans to pay for the $20 million Gateway incentive out of Downtown Northbank Community Redevelopment Area Tax Increment Finance funding. That will prevent the city’s general fund from bearing the brunt.

But council member Raul Arias cautioned the DIA not to use all its funds for a full fiscal year all in one place.

“What about the other smaller projects? Are we going to essentially deplete our TIF dollars and essentially put the burden of any incentive deal moving forward on the general fund?” Arias asked.