I am one of the millions of people who submitted an application for student debt relief. I attended the Florida State University as an out-of-state student from 2004 to 2008. My mother paid cash for my first three semesters. My remaining time at FSU — including my summer in London, where I interned at NBC — was financed by student loans and a Pell grant. I received that grant only after my mother received a letter from the university about how well I was doing academically, then wrote them back saying, “If she’s doing so well, you need to give her some more money or she won’t be returning.”

However, my quest for government assistance with my education didn’t begin when I arrived in Tallahassee. It began my senior year of high school. I filled out my FAFSA form for financial aid and was notified that my expected family contribution was upwards of $29,000. That number was based on my mother’s gross income which had just broken the six-figure mark — after years of working late nights and early mornings as an educator — and I was her only dependent. This all happened against the backdrop of the recession in the early aughts and the bust of the dot com bubble. In short, the money that had been set aside for my college education had been depleted.

It was because of these circumstances that I found myself well acquainted with the FSU financial aid office. During my first visit, I applied for a student loan. On later visits I applied for work study — which I never received — and finally to find out if I qualified for in-state tuition after moving to an off-campus apartment with roommates. On the latter point, I was told that out-of-state students had to show that they could support themselves, were filing their own income taxes and could pay the out-of state fee before ever being considered for in-state tuition. The administrator in the financial aid office said, “Many students have to take some time off from school to do that.”

I held it together in the office, though I felt my face fall and tears sear the corner of my eyes like the unexpected singe you get from an electric shock or touching a hot surface. I’d be lying if I said I didn’t momentarily consider The Players Club route of putting myself through school. While I never had to go through with a half-baked plan to entertain sex work to get an education, I am all too familiar with the sacrifices people make morally, financially and otherwise to get a degree.

My degree, once it was conferred on me, gave me the license to work. My first job out of college was at a TV station in Amarillo, Texas, where I made $8.50 an hour. Journalism, like writing and publishing, notoriously pays its employees crumbs with the expectation that we not only survive, but thrive under conditions where we barely make a living wage and are expected to be on call at all times. On my piddly salary plus some overtime and holiday time when applicable, I paid rent, bought groceries and gas, paid my electric and water bill, cable bill and phone bill, bought my own private health insurance plan (because it wasn’t offered through my job) and made my two student loan payments. Anyone want to guess how much money I had left over after the bills?

If I had $40, it was a good week.

I have dutifully paid my student loans every month, on time, for the last 14 years. I have never defaulted. I have never deferred. When the pandemic hit, I didn’t even take the government up on its offer to delay payments while they figured out forgiveness. I have had some help from my mother, and later my husband, but the debt remains.

I jumped at the chance to apply for forgiveness for the one loan I have left. And I balked at the audacity of six attorneys general who are suing to block the plan.

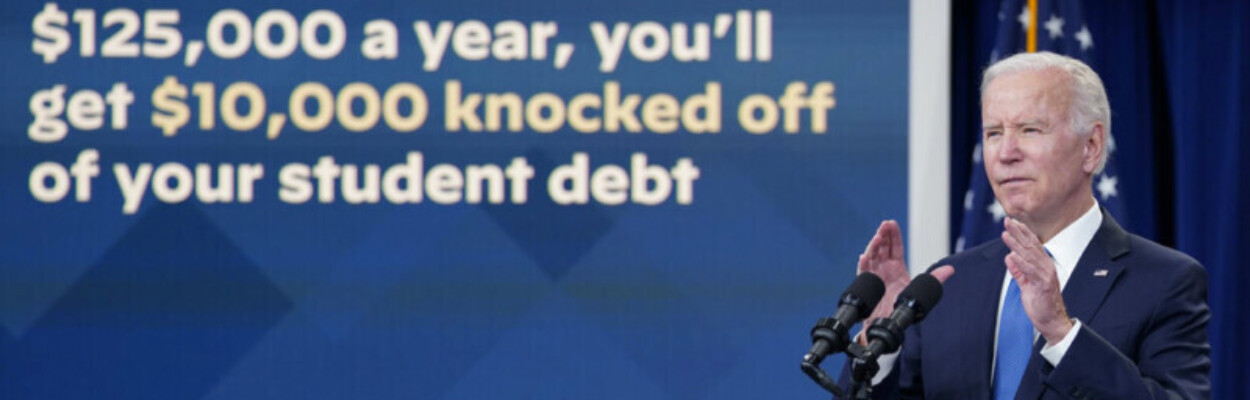

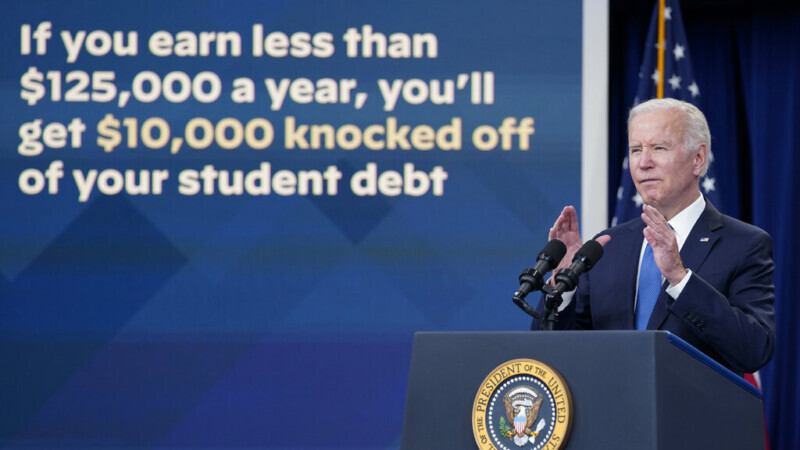

When I began working in 2008, it was only a few months before the collapse of the financial system and the start of the Great Recession. As a working journalist in 2008, I remember the endless calls for the government to do something — something that resulted in TARP, the $700 billion dollar bailout for banks. I remember the bailouts for GM and Chrysler. There were bailouts for AIG, Fannie Mae and Freddie Mac. As for people facing foreclosure, while not everyone could be rescued from the balloon payments of their subprime mortgages that led to their foreclosure notices, extensions were given and homeowners who were underwater on their mortgages were also able to apply for relief. But somehow student debt relief is unfair?

It is no surprise that some of our elected leaders favor propping up certain systems of capitalism that exacerbate inequality, depress wages and limit social mobility and therefore access to real power to make change. But don’t tell me that supporting people who may still have student loans despite also having savings, volunteering or serving in the armed forces is unfair. What is unfair is the rush to cater to the rich with more tax cuts and tax breaks while working people power the economy without the resources or means to feed, clothe and house themselves. Student loan debt relief is a step toward equity. Equality is not a socialist notion. Equality, equity, parity, is an effort to give everyone an even origin.

I left my journalism career in 2019 and spent three years working for myself through my publishing company and freelancing as a writer before I accepted a new full-time position this past April. My new position, and the salary and benefits that come with it, marks the first time since I left home for college in 2004 that I do not worry about money during the weeks between payday. I no longer pay my bills, student loan included, and then look at my accounts and leave it up to the Lord. I am finally able to save money in a way that will give my children a college fund so that they are not in the same position I am, wondering if they’re going to have to borrow from Peter to pay Paul with interest for half of their life.

Providing a pathway to financial freedom for this country’s doctors, lawyers, journalists, writers, nurses, teachers and more is the opposite of unfair. It is right and it is just. It is past time that our government gives to the people who power the country and not to the systems and institutions that act with impunity without care for who they hurt and then demand a handout because they are supposedly too big to fail.

Nikesha Elise Williams is an Emmy-winning TV producer, award-winning novelist (Beyond Bourbon Street and Four Women) and the host/producer of the Black & Published podcast. Her bylines include The Washington Post, ESSENCE, and Vox. She lives in Jacksonville with her family.