The money is aimed at closing a historic Black homeownership gap in Duval, St. Johns, Clay and Baker counties

More than 300 Jacksonville area families are going to receive $20,000 apiece as part of a regional bank’s settlement with the federal government.

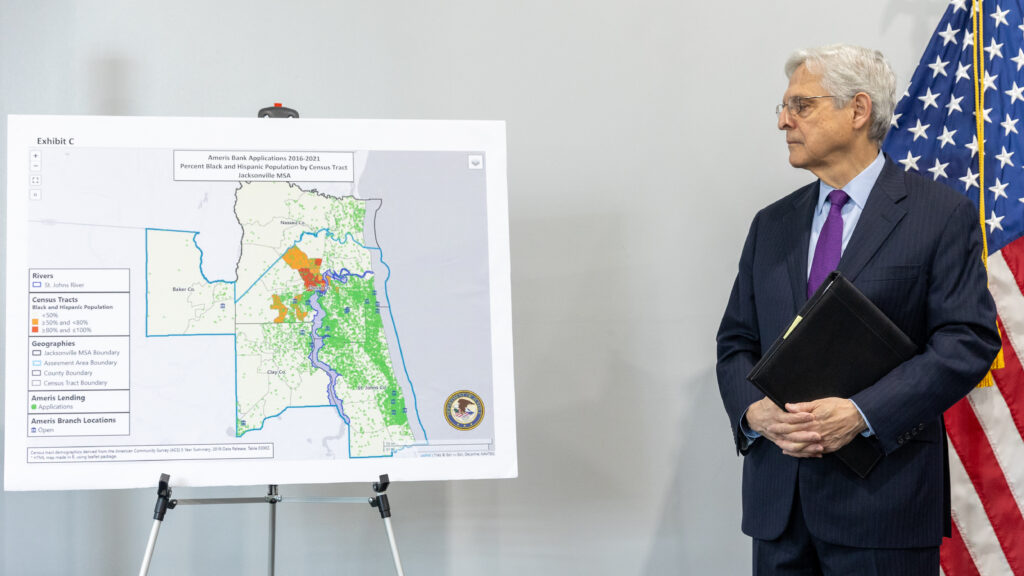

Ameris Bank launched its Ameris Choice program three months after U.S. Attorney General Merrick Garland in Jacksonville announced the settlement over the bank’s alleged redlining in Jacksonville’s majority-Black and Hispanic neighborhoods between 2016 and 2021.

Who qualifies for the money

Qualifying for the program is easier than for similar downpayment assistance programs that are funded by the city or federal government. (For one, Mayor Donna Deegan announced a $2 million pilot program this month to provide first-time homebuyers up to $25,000 toward a home that costs less than $335,000.)

To be eligible for Ameris Choice assistance, an applicant must have:

- A minimum 585 credit rating

- Loan approval for either a conventional mortgage, Federal Housing Administration or Veterans Administration loan

The property must be within a majority-Black or Hispanic census tract in Jacksonville or the borrower must reside in one of those tracts. If that’s the case, the assistance can be applied to purchase a primary residence anywhere in Duval, St. Johns, Clay or Baker county.

During his October visit, Garland said many of the communities that were redlined in the 1930s – places like Durkeeville, Lackawanna, Lavilla, Moncrief and the Eastside – were places where Ameris still refused to engage with Black and Hispanic consumers. Today, some of those previously redlined communities have homeownership rates below the countywide average.

Engaging the community

Ameris Choice was launched in January under the settlement that U.S. District Judge Marcia Morales Howard approved in November. The five-year agreement calls on Ameris to subsidize $7.5 million in mortgages; open or acquire a new branch in a Black or Hispanic-majority census tract north of the St. Johns River; and spend at least $600,000 partnering with organizations to provide financial education and foreclosure prevention in the community.

Also required under the settlement: creating a new position called director of community lending. That person, Clyde Anderson, detailed the program for approximately 75 Jacksonville residents at an evening forum at a charter school in the Highlands community this month.

“You don’t have to make 80% of (area median income) or 120%,” he said, referring to other affordable-housing subsidies, including the city’s federally funded Head Start to Homeownership program that Ameris has participated in for years. “You can actually qualify for the loan, and the income is not a question as long as you qualify.”

Anderson says Ameris’ community education campaign includes speaking at Black churches on Sundays and holding workshops in Black communities on Saturdays.

He acknowledges some residents are reticent to trust Ameris’ intentions after the redlining accusation.

“This is a trial. We’re trying to see if it works,” Anderson told Jacksonville Today after the March 14 meeting.

A mixed reception

Reaction to Anderson’s pitch at the evening info session was mixed. While some attendees furiously scribbled notes and asked follow-up questions, others’ skepticism was plastered across their faces.

“It matters that the government caught it and to give advantages back to Black homeownership,” said Jacksonville resident and developer Julian Armstrong. “But, I wish Ameris did it on their own without having to be corrected. Because if that correction never happened, it would probably still be the same.”

In the Census tract that includes the Highlands neighborhood, where the meeting was held, the homeownership rate is 52.8% — below the county, state and federal averages. Likewise, the homeownership rate in each of the city’s four ZIP codes with at least 60% Black population was below the countywide average of 58% in the 2020 census.

“This opportunity is so right, so we could close that gap of whites having homeownership and Blacks having homeownership,” Armstrong says. “This correction is the right step to make that happen.”

Richard Cuff, another meeting attendee, is still questioning Ameris’ “commitment to to equitable opportunity for homebuyers,” as the company’s CEO put it in a January news release.

Cuff has lived in the Highlands neighborhood for more than 30 years. He asked Anderson directly whether the Ameris Choice program would exist if the bank had not been caught by the U.S. Department of Justice.

“I’ve been at this for 20-plus years,” Cuff told Jacksonville Today earlier this week. “What I was tired of was saying, ‘We need something in this area.’ We are too rich to be considered poor. We are too poor to be rich. We fall into that sweet spot. I’m tired of keeping the community from sliding down that slope…It gets under-invested and then it gets gentrified.”

In a sense, Cuff says he understands banks’ perspective: Extending mortgages in predominantly Black and Hispanic communities can feel like planting trees in barren land.

But because homeownership is an avenue toward creating wealth, a knock-on effect is people can’t use the equity in their home to potentially launch a business, and much more.

A 2022 Congressional Budget Office study of family wealth over a 30-year period found the median wealth of white families in 2019 was 6.5 times higher than Black families’ and 5.5 times higher than Hispanic families’ – largely due to the homeownership gap.

“Remove the barriers to investment and watch what happens when you invest in our community,” Cuff says. “The energy is in the atmosphere to make people listen.”

The Black homeownership chasm

The gap between white and Black homeownership has widened nationwide over the last decade, according to the National Association of Realtors. Over 72% of white people owned their home, compared to 44.1% of Black people and 51.1% of Hispanic people.

That disparity also holds true in Florida, Stetson University Professor Randall Croom told WMFE News in February. The reasons, Croom says, include a higher mortgage-denial rate for Black applicants, as well as a home-appraisal gap between homeowners of different races.

“The way that your house is appraised today, the value of it determines your home equity line of credit,” Croom says. “It determines what you might be able to pass on to someone when you pass on, which further exacerbates the race-based wealth gap.”

In its latest annual race and home buying report, the National Association of Realtors concluded that increasing homeownership rates for Black, Asian and Hispanic buyers will “depend on addressing systemic barriers such as affordability, access to mortgage finance, and housing stock availability.”

One Ameris loan officer who attended the Highlands meeting, Tamonica Mike, grew up in the Highlands neighborhood herself and has worked in banking for two decades.

“What we see in our community, our Black, minority community, is a lack of homeownership,” Mike told the meeting attendees. “We’re trying to create home ownership. That’s important. And that’s what we need in our community. Let’s focus on how can we create this amongst ourselves. Let’s figure out how we can change the outcome for our children. I’m sure all of us in here have kids. We want to create generational wealth (and) doing it through homeownership.”

As Mike spoke, a woman in attendance disagreed under her breath with Mike’s premise that a lack of financial education is the primary reason for stymied Black homeownership.

On the other side of the room, Tiffany Brown listened with the goal of informing others. Brown purchased her first home in the Sweetwater community in September.

Though she wouldn’t benefit from the Ameris Choice program, she knows others who might. Brown is a social worker who created a nonprofit, the Whole H.E.A.R.T. Foundation, that focuses on empowering and informing women in Jacksonville.

“However it’s done, however it happens, it’s good to see someone that looks like us telling us about the opportunity, which makes us trust it a little bit more,” Brown says. “I do appreciate that they acknowledged it. When the hard questions came, they didn’t just sweep it under the rug.”

Now that’s settled

U.S. Attorney General Merrick Garland personally visited Jacksonville's Eastside to accuse Ameris of redlining in October.

“Redlining makes it difficult for people of color to accumulate wealth through the purchase, refinancing or repair of their homes. This has contributed to, and it continues to deepen, the persistent wealth gap in our country,” Garland said at the time.

Duval County’s homeownership rate, 56.5%, ranked 63rd out of Florida’s 67 counties as of the last Census. Only Orange County, Miami-Dade, Leon and Alachua counties had lower percentages.

Assistant Attorney General for Civil Rights Kristen Clarke said in October that Ameris had discouraged lending from majority Black and Hispanic communities in Jacksonville by focusing in predominantly white areas.

Clarke said, from 2016 to 2021, Ameris did not receive a loan application from residents in one third of Jacksonville’s majority-Black and Hispanic census tracts — mostly, on the Eastside, Northwest Jacksonville and on parts of the Westside.

“Our statistical analysis reveals that Ameris’ peer lending institutions were receiving applications in majority-Black and Hispanic neighborhoods at three times the rate of Ameris,” Clarke said. “Our analysis also found that Ameris did not make sufficient efforts to reach neighborhoods of color.

Ameris did not acknowledge any wrongdoing. The Atlanta-based bank agreed to the settlement in order to avoid prolonged litigation.

Today, Jacksonville City Council members Jimmy Peluso, Tyrona Clark-Murray, Reggie Gaffney Jr. and Rahman Johnson, are co-sponsoring a resolution that would acknowledge redlining in Jacksonville.

In addition to its specific mention of LaVilla, Durkeeville, Mixon Town, Sugar Hill, Long Branch, Eastside and Moncrief, the resolution calls for public- and private-sector participation in eradicating the impact of redlining.

“You go in those neighborhoods and you’re still seeing a lack of infrastructure, you’re still seeing a lack of drainage, a lack of lighting, high unemployment,” Peluso tells Jacksonville Today. “What they talked about in 1937, today, we still have the exact same issues. To walk through these neighborhoods and see the limited amount of individuals that have homeownership – we all know the best way to build equity and the best way to build generational wealth is to own a home – we’ve let down our neighbors. We’ve let down our communities.”

Peluso says the council expects the Deegan administration to request a permanent funding source for the downpayment assistance program it launched earlier this month.

“Programs like that are the way governments should be doing to help correct these issues,” Peluso says. “I’m looking to see homeownership go up, especially for younger Americans…We need more young residents moving into those areas, providing their wealth, their upward mobility, in order to help uplift those communities.”

Peluso says encouraging inter-generational and mixed-income homeowners to move into previously redlined communities is a way to ensure their future sustainability.

Nonprofit collaborations like one that created Project Boots on the Eastside are also stepping in to provide down payment assistance and homeownership training.

And once someone has secured their down payment assistance? Jacksonville developer and Northside native Rebecca Williams is working to increase the stock of desirable homes. Her Fruit of Barren Trees is building, rehabilitating and selling properties in Brentwood, Grand Park and Moncrief and targeting working-class and middle-class buyers.

“Where you are planted will, naturally, take root,” Williams told Jacksonville Today in January. “Some of us benefit from trees we did not plant. If I do my part, and pour into people, before you know it, you will have all these trees that are bearing fruit on the Northside of Jacksonville again.”

Lead image: Ameris Bank mortgage officer Tamonica Mike outlines the Ameris Choice program in front of more than 75 people inside Somerset Academy in the Highlands community during a March 14, 2024 community meeting. | Will Brown, Jacksonville Today