Voters in St. Johns County will decide in November whether to pay more in taxes to help fund schools.

The St. Johns County School Board and County Commission greenlit two questions about taxes to appear on ballots.

Voters will get to decide about the continuation of the existing half-cent sales tax for schools and an additional property tax for boosting teacher salaries.

The measures come, school officials said, as the county struggles to keep up with its explosive growth and the competitive salaries nearby school districts are able to offer teachers and other staff.

“I can’t tell you how many times I”ve had teachers say to me, ‘I can go across the line and make $5,000-$7,000 more a year,’” School Board Member Beverly Slough said during a workshop about the items last week.

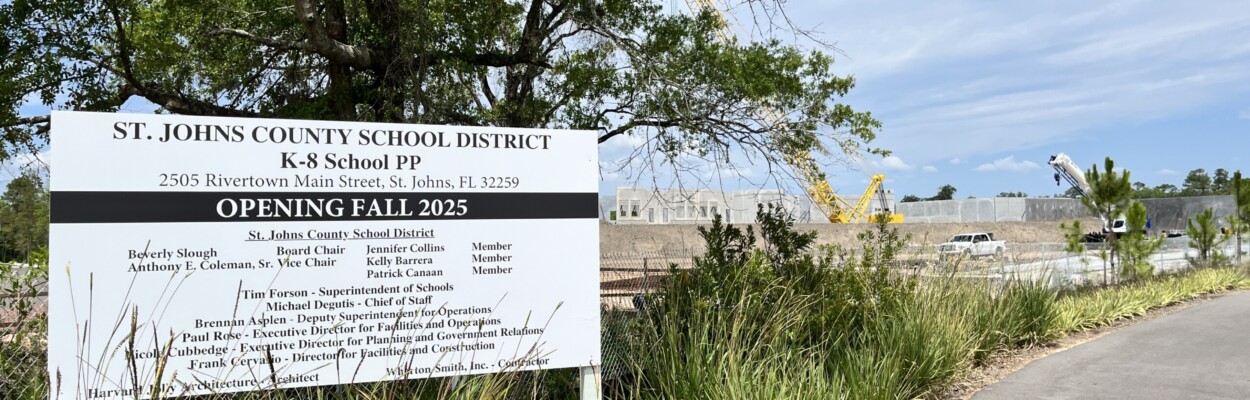

Each tax would go toward different expenses. The half-cent sales tax, which adds a half penny per dollar on many purchases, initially went into effect in 2016. The School Board hopes voters will extend it out another 10 years.

Money collected by the tax — a good chunk of which, Chief of Staff Michael Degutis said, comes from tourists who stop and shop in St. Johns County — would go toward building new schools and sprucing up existing schools.

The property tax, however, is squarely aimed at hiring.

“This will give us money, if the people will agree, for operational expenses, which includes, of course, teacher salary,” School Board Member Patrick Canan explained.

And it’s not just teachers, but also salaries for other instructional staff, bus drivers and more.

If voters approve the measure, they’ll see their property taxes increase by one mill, or $1 per each $1,000 of their home’s assessed value.

The two questions about taxes will appear on every St. Johns County resident’s ballots in November.