UPDATED at 5:48 p.m. Thursday

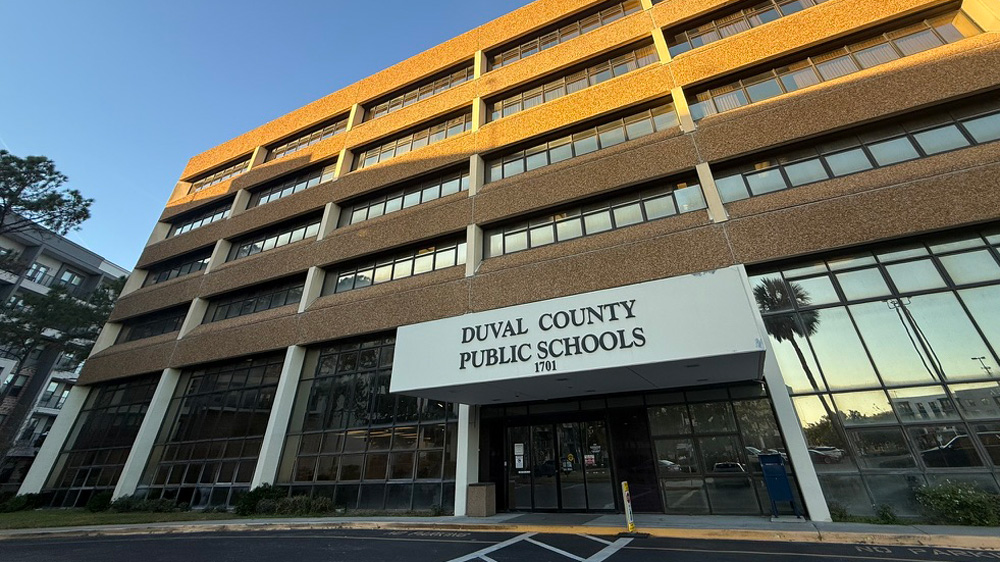

The deal to sell Duval Schools’ headquarters building to local developer Chase Properties has fallen through, putting a hold on the district’s plan to buy a new headquarters building in Baymeadows.

Chase Properties CEO Mike Balanky tells Jacksonville Today that his company withdrew its offer after discovering undisclosed financial obligations that would have cost the company $6 million to $8 million.

The costs would have come through bond obligations tied to an adjacent community development district. Additional fees could have arisen for development rights controlled by the CDD’s owner.

The deal’s collapse comes three months after the School Board voted 4-3 to sell the building to Chase Properties for $17.2 million, after deciding against selling it to retirement community developer Fleet Landing.

Chase planned to tear down the Duval Schools headquarters and build luxury condos and apartments on the riverfront site, as well as space for shops and restaurants.

A Duval Schools spokesperson says “no new timeline has been established for future proposals or decisions.” The district’s administrative offices will stay on Prudential Drive for the time being.

The CDD issue

Several years ago, Elements Development — backed by Preston Hollow Capital — created a community development district called The District to help pay for a major revitalization project on the former site of JEA’s Southside Generating Station.

The development became RiversEdge, a mega project combining residences, retail and parks next to the Duval Schools headquarters.

CDDs are essentially state-authorized microgovernments. Developers commonly use them to raise money to build infrastructure and amenities in large residential developments. They can issue bonds, then pass the cost on to future property owners, who see them as line-items on their property taxes.

The District CDD has raised more than $35 million that way.

Part of Duval Schools’ headquarters property — 1.73 acres — is a parking lot along the river and east of the building itself.

Almost a decade ago, board members agreed to swap some of the school district’s land with Elements Development. According to School Board meeting minutes, they finalized the land swap in June 2018.

That contract foreshadows today’s dispute; it details Elements’ plan to create a community development district.

In this case, one of the things The District CDD paid for was the Duval school district’s new parking lot — to the tune of nearly $1 million. Although Duval Schools was never going to have to pay CDD fees, documents show the expectation was that a future owner might have to.

Staying put

Balanky says Chase Properties thinks the current School Board members were not aware of the CDD issue.

“Based on our understanding, the failure appears to have occurred at the administrative, broker and consultant level during prior land transactions and entitlement processes,” he says.

Michael Hotaling, whose firm appraised the Prudential Drive headquarters building, says CDDs are common in residential developments, but the school board parking lot is an unlikely candidate.

“You wouldn’t think to ask for that on a municipal property,” he tells Jacksonville Today.

Hotaling says he hasn’t studied the issue but anticipates that his appraised value would change because of the CDD debt.

If the CDD debt were removed, Balanky said, he would move forward with his project.

“We continue to believe this riverfront site represents a transformational opportunity for the community and a catalyst for long-term economic growth,” Balanky says. “Chase stands ready to proceed immediately at the originally negotiated price and terms, provided the CDD encumbrance is removed, equitably reallocated, or otherwise fully cured so that the property reflects the conditions under which it was offered, appraised, and contracted.”