Three city lawmakers say they’ll support cutting property taxes and lowering Jacksonville’s millage rate if City Council’s Finance Committee can find cuts to Mayor Donna Deegan’s $2 billion budget when it vets the spending proposal in August.

City Council President Kevin Carrico, Finance Committee Chair Raul Arias and committee member Ron Salem tell Jacksonville Today they want to see a decrease in the millage rate.

Deegan’s budget that she presented to council on Monday keeps the millage rate unchanged from last year. The Republican council members say a drop in the millage rate could mean tax relief to Jacksonville property owners.

“When I think of the affordable housing crisis, a lot of it stems from people not being able to afford their current houses that they’re in due to insurance going up and property values are increasing, which increases their property tax bill,” Carrico says. “I think it’s a way to give some relief to our constituents. If we don’t need to spend all of the money we’re bringing in, let’s put it back in the taxpayers’ hands.”

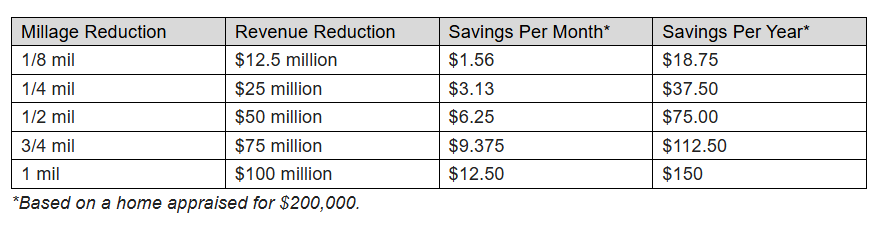

But officials in the mayor’s office say any reduction in the rate will reduce city revenue in 2026 by millions, meaning cuts to public services while saving taxpayers only a few dollars per month.

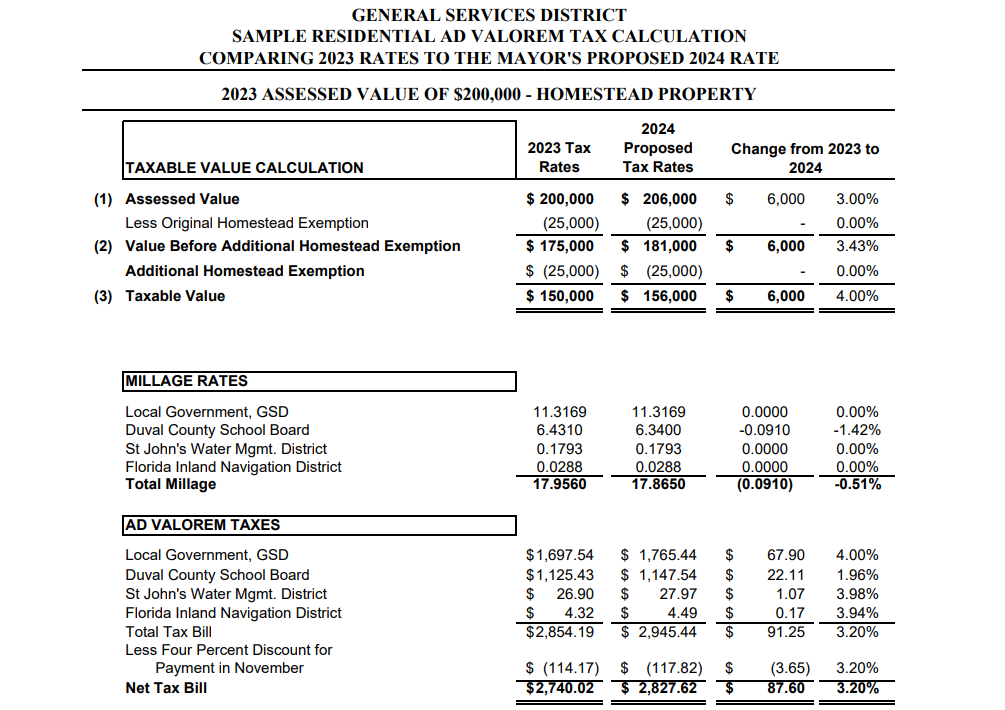

Jacksonville currently has the lowest millage rate of any major city in Florida, according to city officials. Jacksonville’s property tax millage has held steady at 11.3169 for three years. When the city, county, schools and special taxing districts are all included, the millage rate is 17.8650. That’s below Tampa, Orlando, Tallahassee, St. Petersburg and Miami, which has the highest local millage rate at 20.5564.

The last time city leaders lowered the rate was in 2022 as part of then-Mayor Lenny Curry’s final budget when council approved a ⅛-mil cut. Curry held the millage steady for his prior seven years in office.

Phil Perry, chief communications officer for the Deegan administration, says keeping the millage rate steady allows investment in core city services in a time of rising costs.

“It’s also important to remember that inflation is causing costs to rise as we provide services to one of the fastest growing populations in the country. Ad valorem revenue barely covers public safety costs as it stands now,” Perry says in an email to Jacksonville Today. “Lowering the millage rate would hurt police and fire, along with a variety of other city services: potholes, mowing, trash pickup and more. A reduction also impacts our ability to respond to economic downturns in the future.”

For example, a ⅛-mil reduction in the rate would cost $12.5 million in tax revenue and save the average homeowner about $1.56 per month, or $18.75 per year, city calculations show.

Council will take a preliminary vote on next year’s millage rate at its July 22 meeting in order to meet a required deadline to notify residents through a Truth in Millage notice of their possible tax rate.

According to Carrico, after meeting this week with City Council auditors about the feasibility of a cut, any vote to lower the rate will not happen until after the Finance Committee has finalized the budget in late August and sent it on to the full council.

“Auditors recommended approving the rate proposed by the mayor and we can easily go down (with the rate), but going up is much harder and expensive because TRIM notices have to be reissued,” Carrico said.

Under the 11.3169 millage, a typical homeowner with a home valued at $206,000 and after a $50,000 homestead tax exemption would paid $1,765.44 in property tax to the city in 2024. That calculation rises to $2,827.62 after Duval County Public Schools and other taxing districts are added in.

Raul Arias, the first-term District 11 Republican, chairs the Finance Committee and will oversee council’s budget hearings in August. He said during a Finance meeting Tuesday that considering a millage decrease is one of his top priorities if the committee can find the corresponding spending cuts but he “can’t make any promises.”

He says the city’s garbage fee increase approved in May, which he supported, was akin to a tax increase.

“It’s on us to see if we can give (people) some relief,” Arias said.

Deegan’s third city budget is balanced and does not take anything out of the city’s reserve funds – which Council members criticized in her past budgets. The mayor’s finance officials have projected $370 million in operating reserves and $133.84 million in the emergency reserve for the 2025-26 fiscal year.

Salem says he would support a cut of ⅛- to ¼-mill. Duval County taxpayers “deserve a millage cut.”

The council trimmed $70 million from Deegan’s 2024-25 fiscal year budget, paring it down from $1.95 billion to $1.88 billion. Salem says he expects council to be able to cut from the spending plan this year too.

“I think finding $25 million in this budget can be accomplished. I’ve got my eyes on some things but want to wait until we get into the committee process and hear from my colleagues on ideas they might have as well,” Salem said. “I believe we will find those dollars.”