A potential $38.5 million deal between the city of Jacksonville and a developer to redevelop the historic Laura Street Trio of Downtown buildings needs more work, the City Council decided Thursday.

The potential deal – which includes a $22 million city loan for SouthEast Development Group to revitalize the historic Downtown block – was just not ready for City Council approval, members said. Ordinance 2023-876 also includes a $2 million forgivable loan.

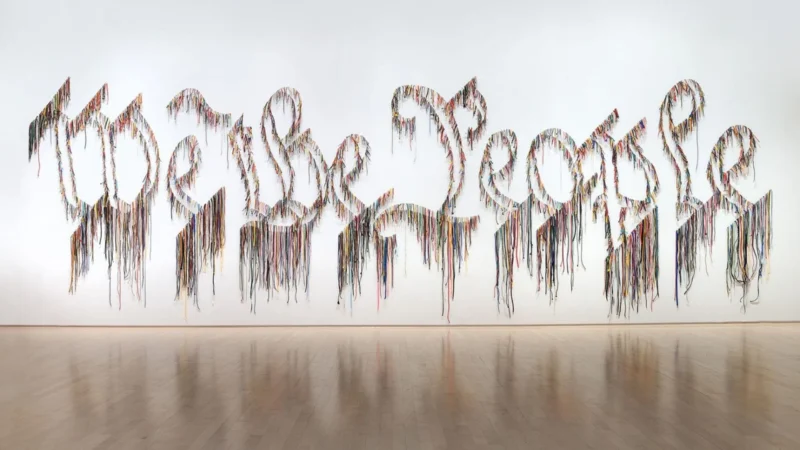

Back in 2013, SouthEast Development Group Managing Director Steve Atkins bought the trio of buildings that includes the Florida National Bank Building, the Bisbee Building and Florida Life Insurance Building, which sit at the corner of North Laura and West Forsyth streets a short walk from City Hall. Atkins wants to transform the group of structures into a hotel, apartments and restaurant.

During a special meeting of the City Council’s Committee of the Whole on Thursday, council members criticized the deal as rushed.

“This is – for lack of a better term – half-baked,” said Councilman Rahman Johnson, adding he was incredibly excited about the project, but questioned the speed to the finish line and a potential deal-closing date at the end of this month. “There are so many holes here that need to be plugged.”

Council Auditor Kim Taylor said her office has been reviewing the deal as written, but assured elected officials that the terms of the deal can change.

She called the lack of details and contract terms “frustrating.”

“It’s shocking that we’re dealing with the deal that’s still being negotiated,” Taylor said. “I mean, our staff has spent a ton of time reviewing the documents and to know that this is going to be changing is a bit frustrating, frankly.”

She said the biggest issue is that as of now, the terms of an agreement can change.

“We don’t know the terms,” Taylor said. “So we’re being asked to be the guarantors… to something we don’t know is definitive. There’s different options in the (indication of interest) letters (from Capital One).”

All council members who spoke said they had hesitations about voting on the deal at this time, including Council President Ron Salem. Salem also questioned why the deal did not incorporate grant funding and other funding sources.

“It seems like if you had the ability to bring in other people, to bring in other equity, we could get a much more comfortable agreement versus the city backing these loans,” Salem said “Can you tell me why we’re not pursuing that type of an agreement?”

Atkins said the project is “unique and challenging.”

“It is probably one of the most challenging projects… in Downtown Jacksonville,” Atkins said. “It is expensive. It is not efficient, because of the historic nature of these buildings. So we have already placed equity in the project. We will continue to do that. But the Capital One product that we had an opportunity to pursue is probably the best case scenario in the market that we’re faced with right now.”

Councilman Matt Carlucci originally introduced the legislation, but he said even he had “too many unanswered questions.”

In the end, Carlucci withdrew the bill and the council booted the proposal back to the Downtown Investment Authority board for a review.

As the Jacksonville Daily Record reported, the authority’s board wants to weigh in on the new, more expensive deal. Back in June, the board sent an earlier version of the incentives package to the City Council without a recommendation. A board member then said in December that the currently proposed loan guarantee would be like writing Atkins a blank check.

While some Council members shared their irritation over a special meeting to discuss a deal that was not ready for a vote, Salem said the discussion was helpful — but he warned he wants the deal “thoroughly vetted” by the Downtown Investment Authority before a vote.

The legislation, no longer an emergency item, reverts back to 2nd reading and will be on next Tuesday’s City Council agenda prior to heading back through committees.

Lead image: Lori Boyer, CEO of Jacksonville’s Downtown Investment Authority, speaks to City Council during a Jan. 4, 2024, special meeting about potential city investment in the redevelopment of the Laura Street Trio. | City live stream