Federal officials say Ameris Bank hindered opportunities for Jaxsons in Black and brown neighborhoods.

Attorney General Merrick Garland visited the Phoenix neighborhood Thursday to allege the bank violated the Fair Housing Act and Equal Credit Opportunity Act by denying or discouraging home loan applications in Jacksonville.

The Department of Justice filed a complaint Thursday morning. It is the first redlining case brought against a bank in Florida history.

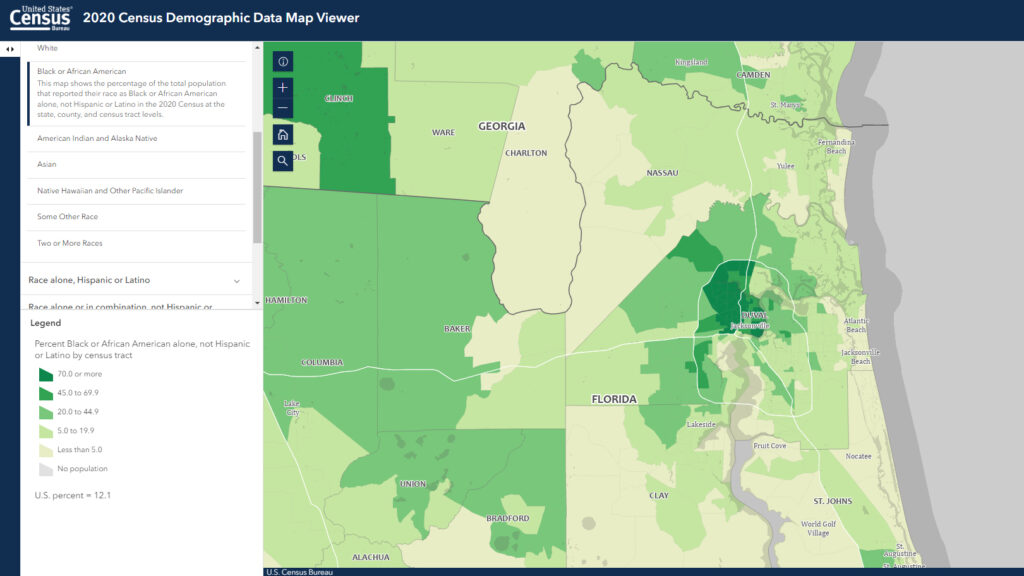

“Our complaint against Ameris alleges that the bank located its branches in specific areas of Jacksonville to serve majority-white neighborhoods and to avoid serving majority-Black and Hispanic neighborhoods,” Garland said. “This included failing to open even a single branch in a majority-Black and Hispanic neighborhood in Jacksonville, despite having opened 18 full-service branches in other areas of Jacksonville.”

The Justice Department and Ameris agreed to a consent order that must be approved by a federal judge.

The order calls for the bank to provide $7.5 million in mortgage loan subsidies over five years in Jacksonville census tracts that have a majority of Black and Hispanic residents.

Those areas are predominantly in Northwest Jacksonville and the Eastside. There would be a $20,000 cap on the amount that applicants could obtain through the subsidy.

Ameris also must invest $900,000 to advertise specifically toward residents of the affected neighborhoods. The settlement calls on Ameris to devote $600,000 toward community partnerships that would increase access to residential mortgage credit.

The Justice Department alleges that in one-third of majority Black and Hispanic tracts, Ameris never extended a home loan between 2016 and 2021. Assistant Attorney General Kristen Clarke said Ameris knew of its redlining in Black and Hispanic communities and did nothing to curb it.

Ameris CEO Palmer Proctor denied the allegations.

“We strongly disagree with any suggestion that we have engaged in discriminatory conduct and are confident in our efforts to provide equal access to affordable mortgage products in the Jacksonville community and all the markets we serve,” Proctor said in a statement.

“We cooperated fully with the department’s inquiry and have entered into this settlement to avoid the distraction of litigation and because we share the department’s goal of expanding access to homeownership in underserved areas. The terms of this settlement are consistent with the Bank’s existing programs and initiatives. We condemn discrimination in any form and remain committed to helping people in underserved communities gain equal opportunity to achieve homeownership, as well as access to banking services.”

Home ownership rates for Jacksonville’s Black and Hispanic communities are below the statewide average. A Jacksonville Today analysis of U.S. Census Bureau data found 65.8% of white households were homeowners in the 2020 census. Fewer than half of Jacksonville’s Hispanic households (46.7%) and Black households (45%) owned their homes.

The Justice Department cited National Association of Realtors data that stated 75% of white households in the state are homeowners, 55% of Hispanic families and 49% of Black families. Nationwide, 72.7% of whites own their home, compared with 50.8% of Hispanics and 44% of Blacks.

“The resolution that we have secured here will provide the strong remedies necessary to promote racial justice and equity to underserved communities of color in Jacksonville,” Clarke, the assistant attorney general, said. “This is transformative relief that will unlock the door to homeownership and intergenerational wealth for residents of communities of color.”

Paul Tutwiler has worked to provide housing solutions in Northwest Jacksonville for more than two decades as the CEO of the Northwest Jacksonville Community Development Corp.

He says low property appraisal rates mean it is more expensive to build a unit in some of the census tracts outlined by the Justice Department than it is elsewhere in Jacksonville.

“We’re challenged with building those units by traditional bankers who want to loan responsible businesses money,” Tutwiler said. “The challenge has been how do you loan money on a unit that is upside down? We have had to come up with creative ways to build those units in a way that helps us to continue our mission to build a mixed-income community.”

The Northwest Jacksonville CDC aspires to provide affordable housing to spur mixed-income home ownership. Tutwiler said his organization does not have a working relationship with Ameris but would welcome one.

Jacksonville City Council member Kevin Carrico was the only elected official in the room. In his full-time position as the vice president of strategic initiatives for the Boys & Girls Clubs of Northeast Florida, he routinely works with children whose families have been targeted through redlining.

Carrico said rising interest rates, as well as down payment dollars, closing costs and Realtors fees, are often barriers to home ownership. He acknowledges Jacksonville’s history of practices that have not benefited its communities of color.

“This is a good day here for Jacksonville to see that our constituents and citizens who have been preyed on and neglected can now have a chance to, actually, close that gap and get that American dream.”

An hour before Garland and Clarke spoke, an unhoused Black man walked north along Liberty Street on a cool morning. A blanket covered his shoulders and neck. His feet were bare.

He embodied the difficulties that many face when denied opportunities.

“Where can our families get loans to buy homes? It’s a challenge,” Tutwiler said. “If you are blocking out Northwest Jacksonville and you are selling in other neighborhoods, how can we possibly make a difference?”

Lead image: U.S. Attorney General Merrick Garland visited Jacksonville on Thursday, Oct. 19, 2023. | Will Brown, Jacksonville Today