For startup founders of all backgrounds, venture capital dollars have become tougher to secure than they were last year — and that’s especially true for minorities, says Jacksonville-based venture capitalist Jim Stallings.

He founded PS27 Ventures a decade ago to invest in early stage tech startups.

“A lot of (venture capital firms) right now are saying, ‘Boy, I have to be very thoughtful,” Stallings says. “They put the highest priority in companies they have already invested in. Most of the companies they have already invested in are white entrepreneurs.”

Startups face more turbulent waters than they have the past couple of years, as the Federal Reserve has hinted more interest rate hikes may be on the horizon later this year as it tries to tame inflation, and startups and tech investors became wary after Silicon Valley Bank collapsed this spring. For Black entrepreneurs, add on that investors and large companies are reconsidering their priorities following a spending spree tied to the country’s racial reckoning in 2020.

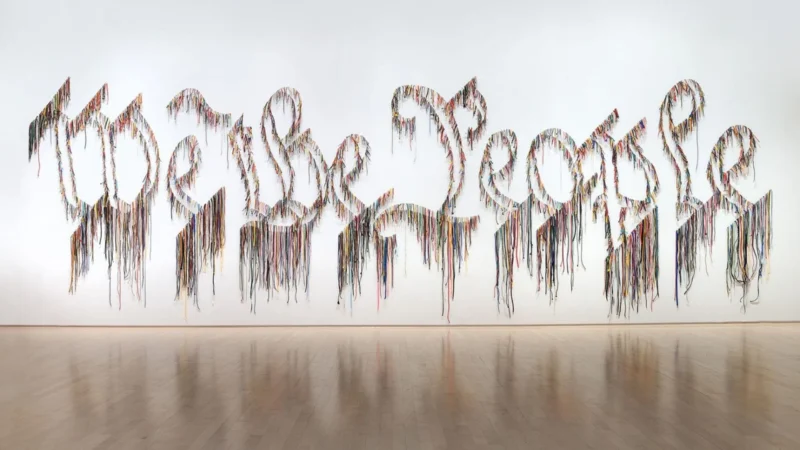

To try to give startup founders some steam, PS27 Ventures hosted a Black Founders Demo Day pitch competition last year and this month’s inaugural Black Founders Forum, which put founders and funders in the same space and included a pitch competition that awarded $250,000 to a Black-owned startup.

Stallings says the biggest hurdle Black founders face is getting in the room with fund managers.

“I talk to Black entrepreneurs all the time. I do a lot of introductions for them,” he says. “They are not getting the time face to face. To do a deal, you have to be in the room with an investor. You can do a lot via Zoom or email, but if someone is writing a check for $1million or $2 million, they are going to meet with you face to face. They are going to go to dinner with you. They are going to meet you a lot of times. (Black founders) are not getting past Zoom.”

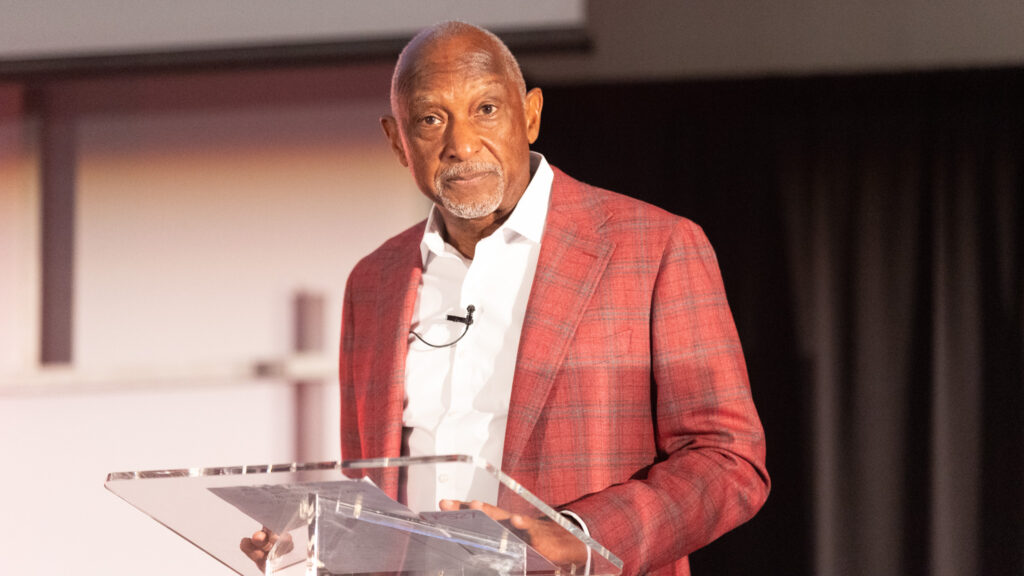

Getting a meeting is one thing, but closing the deal is another. Carla Harris says entrepreneurs who are self-aware of the strengths as well as the shortcomings of their business, and can articulate their story, have a higher likelihood of success when pitching investors.

Harris, a Northwest Jacksonville native who’s now a senior client advisor for Morgan Stanley and longtime member of the Delta Sigma Theta Sorority, shared her pearls of wisdom in navigating the venture capital marketplace as the keynote speaker in her hometown at the founders’ conference.

The challenges have been sudden and jarring for start-up founders, Harris says.

“Investors, their risk profile has gone up a lot, especially in this inflationary environment and an environment where the FED is, basically, raising interest rates,” Harris says.

When her firm had surveyed venture capitalists just last year, it concluded that founders from diverse backgrounds had seen increased interest from venture capitalists.

Over the last five years, less than 2% of venture capital dollars have been awarded to Black founders, according to Crunchbase. The first full year after George Floyd’s death, 2021, saw the highest amount invested in Black-owned startups, an estimated $4.34 billion in venture capital. Last year, $2.25 billion was invested in Black-owned startups — the second highest year on record, but a decline of more than 40% from the previous year’s all-time high.

Now, with the market in flux, Harris said one of the most important choices a start-up can make is determining who is hired in the company’s embryonic stages.

“The market may be there. You may have the solution to the market, but you cannot meet the demand if you’re just one woman or you’re just one man,” she said.

Despite the challenges, according to the Florida Chamber of Commerce, the Sunshine State has the highest number of Black-owned businesses with employees in the country.

Angelique Hamilton is the founder of one of those 15,000 companies. The native Jaxson founded HR Chique Group, a human relations startup that works with firms across America, in 2019.

“It’s a different landscape for us right now, a different world. Probably a year ago, we could go out and secure so many different funds from different individuals and different P.E.’s, but it’s just not like that,” Hamilton says.

She’s hoping entrepreneurs will remain connected to each other and capitalize on the momentum created at the Black Founders Forum. Doing so, she says, will create a stronger local start-up sector as well as legacies that “can give back to the Jacksonville community.”

Another founder, Natalie Mitchell, founded N’sentials in 2021 and is developing its prototype of the women’s intimates line. Mitchell, who is in the pre-seed stage, says she now knows to approach angel investors as she looks to launch. She came to that realization after chatting with Founders Day speaker Barry Givens.

Givens is the managing partner of Collab Capital, an Atlanta-based venture capital firm that funds early stage Black entrepreneurs. He warned of another headwind for founders who might hope to go public in a few years: “The (initial public offering) market is dead” — at the moment.

Collab Capital invested $3.5 million this year in start-ups it had already funded, but $0 in new companies.

Givens says it’s a cycle: Venture capital firms do not have as much to invest in newer startups because their dollars are tied up in other companies that are struggling to grow enough to become publicly sold or acquired by larger companies.

“As investors, it makes it harder for us to raise funds, which then (trickles) down to the founders,” Givens says. “We can’t write checks at the same frequency. We had to slow down, which means the founders are now struggling to raise capital.”

At this moment, Givens believes only truly disruptive ideas will be funded.

It’s a 180-degree shift from three years ago, but he knew that wouldn’t last.

Three years ago this month, investment banks, retailers, sports leagues and scores of other companies committed to devote more dollars to diversity, equity and inclusion in the aftermath of George Floyd’s killing in Minneapolis. Givens considered many of those initiatives “performative capital” and warned entrepreneurs to not rely on a permanent flow.

“Some of these larger corporations, they’re having to now look at their DEI budgets and say, ‘Hey, I know we promised this, but the way the markets are looking right now, we can’t really do that anymore,’ Givens says. “If you go into it, putting all your eggs into one basket, it does hurt.”

Despite the challenging environment, Harris, with Morgan Stanley, says the good news is a market in turmoil is an ideal time to start a company.

That’s what Harris’ grandmother Emma Jane Smith did in 1949 – another period when the Federal Reserve raised interest rates rapidly in an attempt to fight inflation.

The New Berlin native opened a sundries business Out East, at the corner of 4th Street and Florida Avenue, in 1949. Harris says her parents – the late John and Billie Harris – were a commercial fisherman and an educator who raised her in a no-excuses household in the Harborview neighborhood. The Bishop Kenny alumna went on to earn two Harvard degrees and enjoy a 36-year career on Wall Street that has seen her help scores of companies reach the initial public offering stage, perform at Carnegie Hall as a vocalist and advise presidents.

“What I did know, and what I learned while I was here in Jacksonville, is that when you commit yourself to excellence at the top of your game, it amplifies your choices. You have more choices the better you do,” Harris says.

Recognized with a Lifetime Achievement Award from Crain’s New York this month, Harris says she was inspired by the opportunity to talk with those at the start of their entrepreneurial journey.

“A lot of people don’t realize what’s in front of them,” Harris says. “They know they have a great business plan. They know they have a great opportunity. But, to understand what the personal evolution is going to look like around leadership — and it’s going to take that in order to manifest as a billion-dollar opportunity — is something, as I said, that’s inspiring to me to be able to share.”