A former CEO in Jacksonville was sentenced to 32 months in federal prison for trying to evade the assessment of his federal income taxes, according to the U.S. Department of Justice.

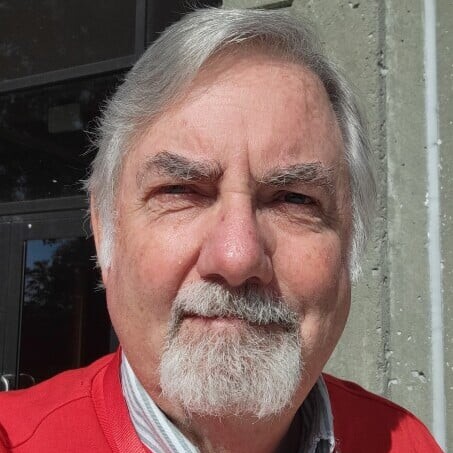

Jason Cory, 49, also faces 36 years of supervised release after his prison term ends. He must pay back $606,195 in restitution for evading more than $600,000 in taxes, federal prosecutors said.

Cory was a manager of a New York-based IT services company in 2015 and 2016, then became CEO of a different IT company based in Jacksonville, according to court documents and statements made in court.

From 2015 through 2018, Cory used his positions to see more than $1.5 million deposited into the bank accounts of Gambit Matrix LLC, a shell company he controlled. As CEO, Cory made the transfers under the false pretense that they were payments for consulting services that had never been provided, court documents said.

Cory did not report the income he earned through those transfers on his 2015 tax return,and did not file anything from 2016 through 2018 as required by law.

To conceal the fraud and evade income taxes for those years, Cory invented fictitious owners of the shell company, made false representations to his employer and falsified emails and IRS forms. He also used the money directed to the shell company to pay for personal expenses, evading more than $600,000 in taxes, court documents showed.

9(MDEwNzczMDA2MDEzNTg3ODA1MTAzZjYxNg004))