Jacksonville City Hall’s debt to the Police and Fire Pension Fund now tops $3 billion — one of the fund’s worst conditions in the past quarter century — a mountain of red ink that will require taxpayers to cover a record $201 million payment later this year.

That payment will strain a budget already expected to be stretched thin by rising costs, expired federal money and expensive obligations. More than $21 million of that increased cost over the current budget year’s $178 million pension payment is attributable to across-the-board pay raises Mayor Donna Deegan agreed to provide police officers and firefighters in collective bargaining talks last year, according to the pension fund’s annual actuarial report.

The unfunded liability — the deficit between the retirement obligations the fund must cover and the assets it possesses to cover them — crept over $3 billion after reaching its previous high last year of $2.8 billion. That means the pension fund is about 44% funded, one of its worst conditions since 2000, when police and firefighter retirements were nearly 87% funded.

Although the $201 million City Hall must pay next October would far exceed its annual obligation in any prior year, the pension fund’s actuarial firm, GRS, said city officials should consider pouring more money in.

“… it is advisable to consider making contributions to the fund in excess of the minimum required contribution shown in this report,” the firm wrote to members of the Police and Fire Pension Fund board.

The board unanimously adopted GRS’ report last month.

The skyrocketing annual pension costs are critical because they sap the same pot of money — the general fund — that is also used to fund libraries, parks, police and fire protection and other quality-of-life services throughout the city.

Pension debt history

The deteriorating health of the pension fund is not a shock to city officials, who are living under a complex pension-reform plan championed by the previous mayor, Lenny Curry, that aimed to give City Hall short-term breathing room on exploding annual pension payments.

That plan, in part, dedicated the future proceeds of a half-penny sales tax toward paying off the pension debt. In turn, the city also essentially refinanced the debt, giving itself a longer time horizon to pay it off and making lower annual payments until that sales tax revenue begins flowing in 2031.

The arrangement all but guaranteed the pension fund’s finances would suffer through the decade.

Curry’s plan did lower the city’s annual payments in subsequent years, but GRS noted the longer payoff on the overall debt “carries more risk” and is “likely to transfer costs to future taxpayers,” who will be paying through nearly 2060 before fully funding police and firefighters’ retirements.

And the temporary financial relief from Curry’s plan did not fully alleviate City Hall’s short-term pain. City officials are still facing accelerating and large annual payments: Just five years ago, the city’s annual contribution was a little over $157 million.

Union negotiations

Last year, Deegan struck a lucrative bargain with the police and firefighters unions, which, while celebrated by City Council members of both parties and quickly approved, also prompted concerns about its future cost. Last October, city firefighters got a 12% pay bump and police received a 13% jump. This October, each will get another 5% hike, followed by another 5% hike in 2026.

More than $21 million of the $201 million payment due in October stems from those pay raises, GRS estimated, a substantial but indirect way the pay raises will add to taxpayers’ obligations in the future: Higher pay for an officer today means higher pension payments when that officer retires.

Curry’s reform plan closed the Police and Fire Pension Fund to new hires, who instead receive a 401(k)-style retirement plan. But Deegan backed a plan last year to move new hires into the Florida Retirement System, the statewide pension plan, which local public-safety union officials have argued for years was necessary to crucial recruitment and retention problems.

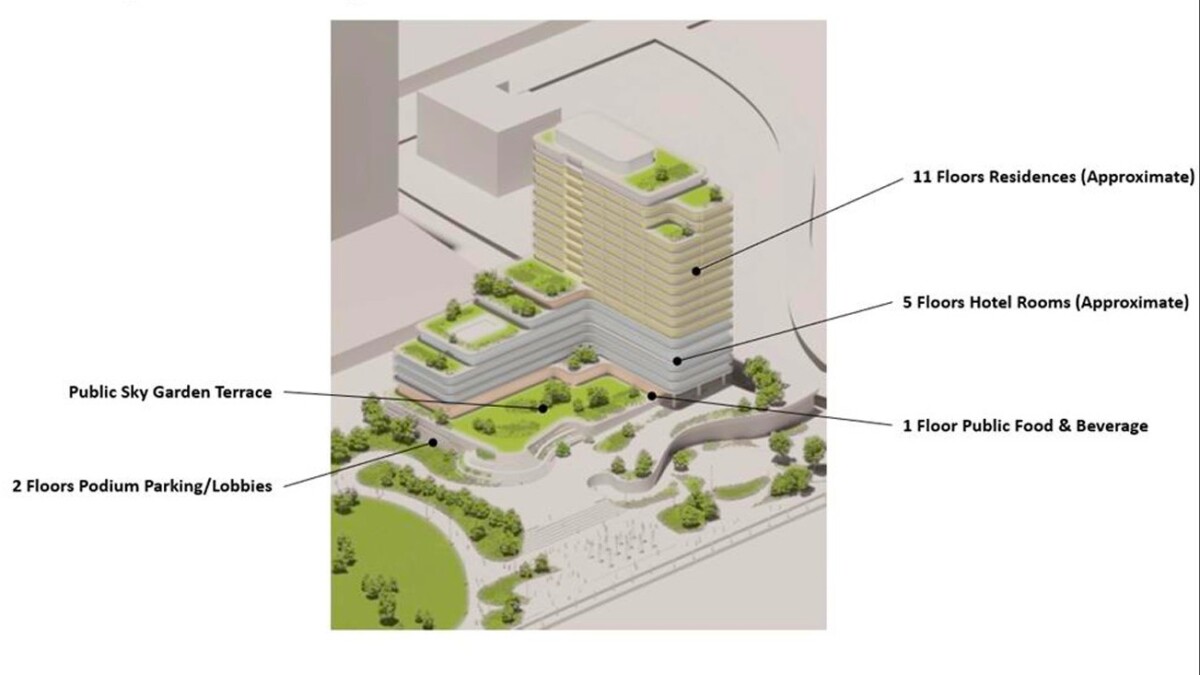

Deegan and the City Council also approved an agreement last year to help fund a major renovation of EverBank Stadium, a $775 million taxpayer obligation, in tandem with tens of millions more in community-benefit projects that were part of negotiations with the Jacksonville Jaguars. City officials are interested in construction of a new jail, which could prove to be a major infrastructure project in its own right, and are often asked to help fund private Downtown development projects.

The upshot is a city with large obligations on its books and on the horizon and which seems to be anticipating more difficult budgets in the coming years. Last week, a JEA committee approved a potential one-time extra $40 million payment to the city in the next fiscal year, a cash infusion from its municipally owned utility that would give City Hall more discretionary money to spend.

This story is published through a partnership between Jacksonville Today and The Tributary