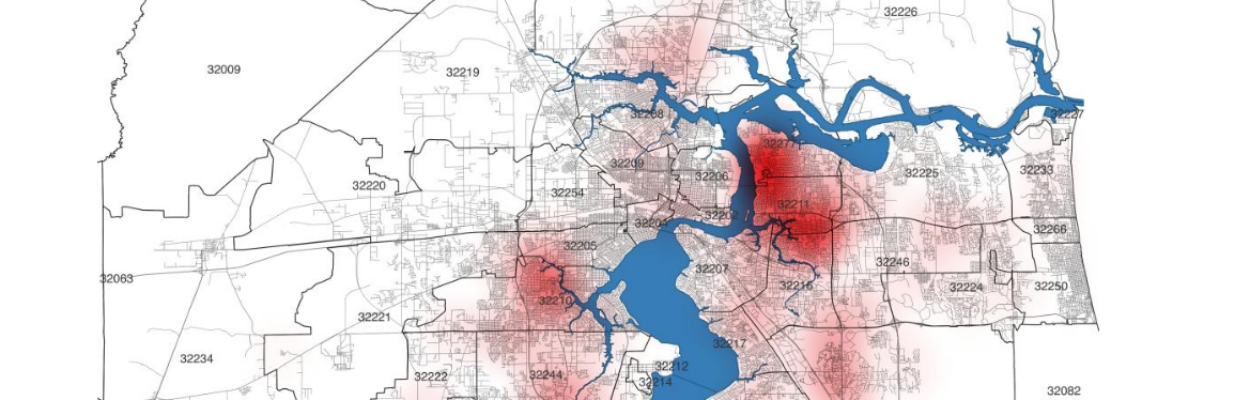

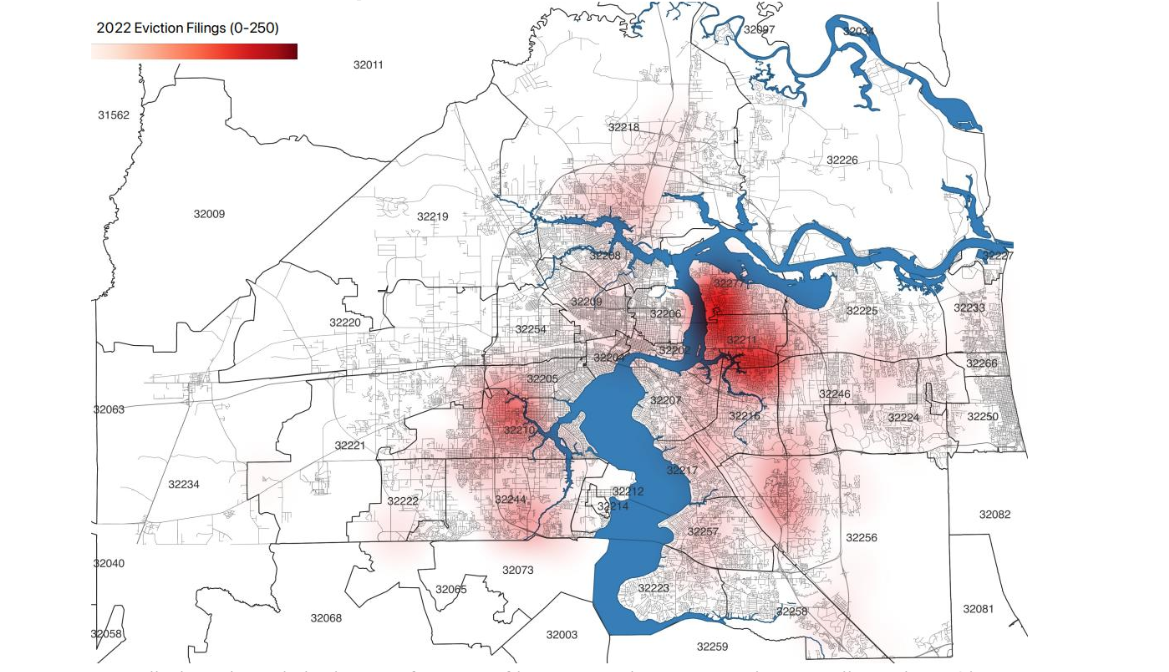

A high number of evictions is exacerbating Jacksonville’s affordable housing crisis.

Duval County was named the eviction filing capital of the state in a recent study by the JAX Rental Housing Project, a research project of the Northeast Florida Center for Community Initiatives at the University of North Florida.

Renters in Jacksonville have seen price hikes close to 30% since 2020 which has created dire situations for families and individuals who can’t keep up with rising rents.

“Housing, human shelter, something that everyone needs is now becoming an asset class investment,” said David Jaffee, UNF professor of sociology.

Jaffee and Katelyn Renzi, a student triple-majoring in sociology, political science and interdisciplinary studies, are behind the findings, as reported by News4Jax.

“When we started this project in 2022, we were really looking at what factors are contributing to the spike in rents in Jacksonville,” Jaffee said. “So we decided we need to investigate the corporate landlord invasion, not just in the single-family sector, but also in the multifamily sector.”

For the last two years, the two compiled data on every multifamily apartment complex in Jacksonville with 10 units or more, collecting information on evictions, code violations and sales information.

“The pattern that I noticed was that investment firms by far more than any other ownership class had way higher evictions and tend to use a lot of the same property management companies and these companies sort of almost automatically were evicting residents, for you know, a variety of reasons,” Renzi said.

RELATED: More than a third of local families struggle

The research pinpoints Duval County as the eviction capital of the state with a monthly average eviction rate almost double that of Miami-Dade County.

According to the study, the monthly average of eviction filings per 1,000 renters in 2022 was 7.08 in Duval County versus 3.70 in Miami-Dade County, 5.84 in Orange County (Orlando), 4.77 in Hillsborough County (Tampa), and 3.50 in Pinellas County (St. Petersburg). This pattern is repeated for 2023 based on the data through September 2023.

Part of the problem is that almost 72% of multifamily rental properties are owned by real estate and investment firms.

“There’s the business model that we associate with the financialization of human shelter,” Jaffee said. “They buy up these properties. They bundle them together into a portfolio, and they make that available to their investors.”

Their research suggests that corporate landlords face pressures from investors to file evictions and remove tenants.

“One of the things that they like to do is if somebody has been there paying a certain level of rent, it’s often easier to bring somebody in new, OK, who hasn’t lived there and didn’t know that the rent was $1,100. Now it’s $1,400,” Jaffee said.

Renzi described this as taking the humanity out of a tenant-landlord relationship.

“It’s a very different dynamic, if you know who your landlord is. If they’re somebody who lives in the community and has a vested interest in making sure the community is healthy and sustained versus an investment firm who’s probably based in New York and whose primary objective is to make as much profit in the three to five years that they can on the property,” she said.

Local policies including a tenant bill of rights could help bring evictions down. Jaffee said the high rates of evictions can also be partially explained by weak tenant protections in Florida.

Duval County, however, is the only metro area without a tenant bill of rights.

This story was produced by News4Jax, a Jacksonville Today news partner.